BTC Price Prediction: Technical Setup and Market Factors Analysis

#BTC

- Technical indicators show improving momentum with MACD turning positive and price holding above key support levels

- Mixed fundamental factors create balanced risk-reward scenario with regulatory developments offsetting macroeconomic pressures

- Historical patterns and institutional framework development support medium-term bullish thesis despite short-term volatility

BTC Price Prediction

BTC Technical Analysis: Key Indicators Signal Potential Rebound

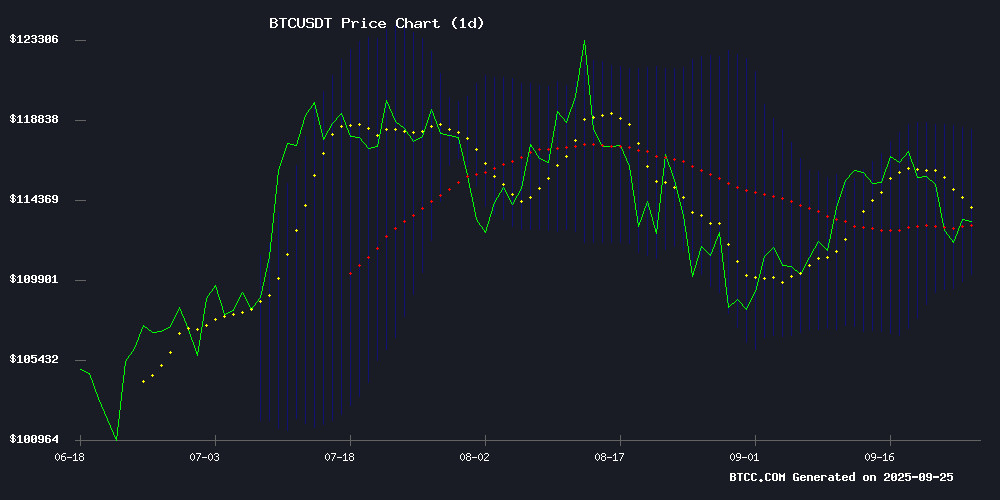

BTC currently trades at $112,462, slightly below its 20-day moving average of $114,211, indicating near-term consolidation. The MACD shows improving momentum with the histogram at 638.91, suggesting weakening bearish pressure. Bollinger Bands position the price above the lower band at $110,114, providing technical support. According to BTCC financial analyst Olivia, 'The convergence of MACD improvement and Bollinger Band support around $110,000 creates a potential springboard for upward movement, though resistance at $113,000 remains critical.'

Mixed Market Sentiment as Fundamental Factors Weigh on BTC

Market sentiment reflects cautious Optimism despite headwinds from gold's rally and regulatory developments. Positive catalysts include historical pattern similarities suggesting potential rallies and Senate hearings that could bring regulatory clarity. However, pressure from traditional safe-haven assets and ongoing criticism creates uncertainty. BTCC financial analyst Olivia notes, 'While macroeconomic uncertainty and gold's performance create short-term pressure, the underlying institutional interest and historical patterns provide counterbalancing support for Bitcoin's medium-term prospects.'

Factors Influencing BTC's Price

Bitcoin 'Cheat Code' Signals Potential Rally as Historical Patterns Reemerge

Bitcoin's price trajectory is drawing heightened attention as cyclical indicators that preceded previous all-time highs resurface. A technical analysis by strategist CrypFlow identifies the 73 level on Bitcoin's 2M SNAB Relative Strength Index (RSI) as a critical threshold—historically acting as resistance before transforming into support during bull markets.

The pattern, consistent since 2013, suggests reclaiming this level could ignite another parabolic rally. Bitcoin currently trades above $112,500, with traders monitoring whether the setup will mirror past cycles where breaches of the 73 RSI level preceded record-breaking gains.

CrypFlow's model shows breakdowns from the extreme 98 RSI level marked cycle tops in 2013, 2017, and 2021. Market participants now watch for confirmation of this 'cheat code' playing out once more.

Bitcoin Under Pressure as Gold Hits Record High Amid U.S. Economic Uncertainty

Bitcoin's recent underperformance contrasts sharply with gold's rally to all-time highs. The cryptocurrency has slumped to $112,000 as institutional investors withdraw $466 million from BTC ETFs, reflecting growing risk aversion. The U.S. Economic Policy Uncertainty Index's dramatic spike to 617.32 signals mounting macroeconomic headwinds.

Market dynamics reveal a stark divergence: while retail investors remain hesitant, institutions are accelerating their exits. This capital flight threatens to exacerbate Bitcoin's downward momentum unless buying pressure resurges. The cryptocurrency now ranks eighth among global assets, trailing traditional safe-havens but still outperforming major corporations like Meta and Saudi Aramco.

Analysts attribute the stress to a perfect storm of electoral uncertainty, Federal Reserve policy debates, and escalating trade tensions. Historical patterns suggest such policy uncertainty spikes typically precipitate extended volatility across risk assets, including the S&P 500—a correlation now weighing heavily on crypto markets.

US Senate to Hold Hearing on Crypto Taxation with Industry Testimony

The US Senate Finance Committee has scheduled an October 1 hearing titled 'Examining the Taxation of Digital Assets,' signaling a pivotal moment for cryptocurrency regulation. Coinbase's Lawrence Zlatkin and Coin Center's Jason Somensatto will testify, addressing tax reporting complexities, asset classification, and potential legislative reforms.

Chairman Mike Crapo emphasized the hearing's role in clarifying the current 'unclear tax environment' for stakeholders. The session follows growing calls for updated rules to reflect crypto's maturation, with Senator Cynthia Lummis recently proposing a bill to revise tax treatment thresholds for bitcoin and other digital assets.

Bitcoin Market Shakeout Hits $1.8B as Traders Seek Hidden Gems Amid Volatility

The cryptocurrency market endured its fourth-largest liquidation event of 2025, with $1.8 billion in leveraged positions wiped out across 370,000 traders. Bitcoin briefly plunged to $111,800 before recovering to $112,863, exposing dangerous levels of speculative excess.

Long bets accounted for $1.6 billion of the liquidations, revealing widespread bullish sentiment before the cascade. Major exchanges saw unprecedented collapse volumes as over-leveraged positions unraveled.

Analysts suggest this reset may create opportunities in presale projects and undervalued assets. Market participants are increasingly viewing such shakeouts as necessary corrections rather than existential threats.

Gold’s Rally Leaves Bitcoin Struggling for Momentum Amid Market Shifts

Gold and Bitcoin, often viewed as alternative assets and hedges against inflation, are showing divergent performances in the current market cycle. Despite sharing similar bullish drivers—such as looser monetary policy, ETF inflows, and corporate adoption—the two assets have failed to rally in unison.

Gold has repeatedly set record highs in recent weeks, reinforcing its status as a SAFE haven. Bitcoin, meanwhile, has struggled to gain upward traction, even as it benefits from the same macroeconomic tailwinds. This suggests investors may only have the appetite to push one hedge asset higher at a time.

A brief shift occurred Wednesday, with gold slipping 1.5% to $3,759 per ounce while Bitcoin gained 1.7% to $113,700. The MOVE highlights how gold’s momentum shifts could temporarily create opportunities for Bitcoin.

Longer-term trends show both assets generally moving in the same direction. Year-to-date, Gold is up 42% compared to Bitcoin’s 22% gain. Since early 2023, gold has more than doubled, while Bitcoin has surged six-fold, recovering strongly from previous downturns.

Bitcoin Faces Bear Market Claims as Peter Schiff Doubles Down on Criticism

Bitcoin critic Peter Schiff has intensified his skepticism, declaring the cryptocurrency is now in a bear market. His September 24 post on X highlighted a 20% decline in BTC against gold since August, framing it as a failure to live up to its 'digital gold' promise. The crypto community swiftly countered, arguing Schiff’s analysis overemphasizes short-term volatility.

Gold’s 11% monthly rally contrasts sharply with Bitcoin’s 8% pullback from its August 13 peak of $123,800. Analyst Stockmoney Lizards echoed Schiff’s bearish outlook, citing a rising wedge pattern in BTC’s chart, with $112,000 as critical support. The debate underscores the tension between traditional safe-haven assets and crypto’s evolving narrative.

Athena Bitcoin Faces Lawsuit Over Alleged Source Code Theft

AML Software has taken legal action against Athena Bitcoin Global Inc., accusing the Bitcoin ATM operator of conspiring to steal its proprietary source code. The lawsuit, filed in federal court, alleges copyright infringement and trade secret theft, marking a significant legal challenge for Athena.

The complaint details a scheme involving Jordan Mirch, CEO of Taproot Acquisition Enterprises, who is accused of orchestrating the misappropriation. AML claims its copyrighted code was never licensed for sale to Athena, despite the latter's attempts to acquire it.

The case also implicates SandP Solutions, a former operator of 2,800 Bitcoin ATMs, which faced regulatory hurdles in Ohio. The legal battle underscores the intensifying scrutiny over intellectual property in the cryptocurrency sector.

Bitcoin’s Path Unclear As Subwave Chaos Meets Key Resistance At $113,000

Bitcoin’s price action remains entangled in uncertainty as chaotic subwave structures collide with a critical resistance level at $113,000. The market shows tentative signs of recovery, yet ambiguous wave patterns leave traders divided on whether the next move will be a breakout or a deeper correction.

Crypto analyst TARA highlights the messy subwave structure, noting Bitcoin’s current formation suggests another potential downward wave. The $113,500 resistance zone has already been tested, but weak bullish momentum leaves the door open for bears to regain control.

The $111,000 level emerges as a crucial support threshold, closely aligned with Fibonacci retracement levels. A decisive break below this point could trigger extended downside pressure, while holding above it may offer bulls a chance to reclaim momentum.

Crypto Market Reacts to Powell's Cautious Fed Stance

Federal Reserve Chair Jerome Powell's tempered remarks on inflation and interest rates sent ripples through cryptocurrency markets this week. Bitcoin briefly dipped to $111,000 before recovering to $112,000, while altcoins showed mixed performance. The Fed's shift toward neutral policy reflects growing concerns about employment and inflation risks.

Market analysts remain cautiously optimistic despite near-term volatility. "With valuations stretched and leverage elevated, markets may continue to react sharply to macroeconomic data," noted 21Shares strategist Matt Mena. The crypto sector appears to be entering a phase where macroeconomic policy decisions carry increasing weight for digital asset valuations.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents a compelling case for strategic investment with appropriate risk management. The technical setup shows promising signs with MACD improvement and solid support levels, while fundamental factors include both supportive and challenging elements.

| Factor | Assessment | Impact |

|---|---|---|

| Technical Indicators | Positive Momentum | Bullish |

| Market Sentiment | Cautiously Optimistic | Neutral-Positive |

| Regulatory Environment | Evolving Clarity | Medium-Term Positive |

| Macro Conditions | Mixed Signals | Short-Term Challenge |

BTCC financial analyst Olivia emphasizes, 'Investors should consider BTC as part of a diversified portfolio, recognizing both its growth potential and inherent volatility. The current technical setup suggests favorable risk-reward characteristics for medium-term positions.'